Educational Programs & Operations Renewal Levy

On Tuesday, February 9, 2021, Wenatchee School District residents will be asked to vote on a ballot item to renew our current four-year Educational Programs and Operations (EP&O) Levy. This levy is primarily for costs related to supporting core learning activities, technology, safety, and our ability to offer elective/specialist classes, field trips, and extracurricular programs such as art, drama, music, and sports.

Levies allow a school district to provide things that the state only partially funds.

A local levy is one source (12%) of the three common revenues used for funding Washington public schools. Other sources include general state apportionment based on student enrollment (77%) and federal funds based on exceptional student needs (9%). The remaining 2% consists of facility use fees, student fees, meal costs, etc.

District Budget

The proposed levy will support approximately 12% of the District’s budget and will maintain the District’s current level of educational programs and operation.

Although we did not have all students on campus during the COVID-19 pandemic, our expenditures and need to have all programs ready to reopen did not stop. Yes, we have reduced hours and positions, yet buildings, grounds, business offices, technology, and administration have all worked non-stop to shift from on-campus to remote learning, and now back to on-campus for hybrid instruction. As with other pandemics, this one will end and a new normal will emerge. As it does, Wenatchee will need to be ready to continue to prepare students to be college and career ready.

Levy Frequently Asked Questions

We know there are always a lot of questions about ballot measures. Review our frequently asked questions below to see if your question has been answered.

Simply put Levies are for LEARNING and Bond are for Building

A levy is a short-term, local property tax passed by the voters of a school district that generates revenue for the district to fund programs and services that the state does not fund or fully fund as part of “basic education.” Levies require a simple majority to pass (50% + 1). A replacement levy is the renewal of an existing levy that is about to expire. Typically, if a district is asking for a replacement levy to be approved by voters, it means that it is simply the continuation of an existing tax.

WSD will be asking voters to approve a renewal EP&O levy on February 9, 2021.

In contrast a bond provides funding for capital projects such as purchasing property for schools, constructing new schools, or modernizing existing schools. Bonds are sold to investors who are repaid with interest over time from property tax collections, generally between 10-25 years. Bonds require a super majority to pass (60%).

Educational Programs and Services (EP&O) allow a school district to provide things like counselors, nurses, teachers, support staff, technology and supplies that the state only partially funds. Levies also fund athletics, arts, and extra curricular programs.

Funding provided by the state does not fully cover the actual costs to operate a school district, so levies bridge the gap in funding.

The Educational Programs and Operation Levy provides funds for the following.

Program Support

- Program Support

- Equipment

-

Supplies

Technology

Program Support Funding:

- Lowering class size

- Instructional assistants and support

- Additional class offerings, such as online learning

- Music, athletics and other extra-curricular programs

- Elementary art specialists

- K-12 counselors

- Student Enrichment program

- AVID - Achievement Via Individual Determination

Equipment and Supplies Funding:

- Classroom textbooks

- Schools Materials and supplies

- District operational costs

- Utilities

- Transportation services

- Capital equipment and replacement

- Nurses, Safety & Security Services

Technology Funding:

- Technology Hardware

- Software

- Training

- Operations Support

The Washington Constitution limits educational programs and operation (EP&O) levies to a period not to exceed 4 years. Wenatchee’s levy funds are collected over a four-year time period and must be renewed (similar to a magazine subscription). A Renewal Levy asks voters to replace an existing levy that is scheduled to expire.

The District’s proposed 4-year EP&O levy will replace the prior levy approved by the voters in 2017 and set to expire in 2021.

Yes, but the funding does not cover the actual costs of operating a school district. The Washington State Supreme Court decision on the McCleary lawsuit resulted in public school districts seeing a net funding increase in 2018. Even though the state increased the amount of funding it was providing to school districts, it also capped the amount of funding school districts can raise from local levies. The Legislature also applied restrictions to how funding can be used. For local school districts, this means that levies have been significantly impacted, causing widespread confusion in communities across the state.

A levy rate is the amount of property tax per $1,000 of assessed property value to fund a voter approved levy amount. A levy rate of $1.00 means that for every $1,000 of property value, the owner of the property will have to pay $1.00 in taxes.

Example: If a homeowner has a home valued at $200,000 and the levy rate is $1.00 for every $1,000 of assessed property value, the homeowner will pay $200 annually in property taxes.

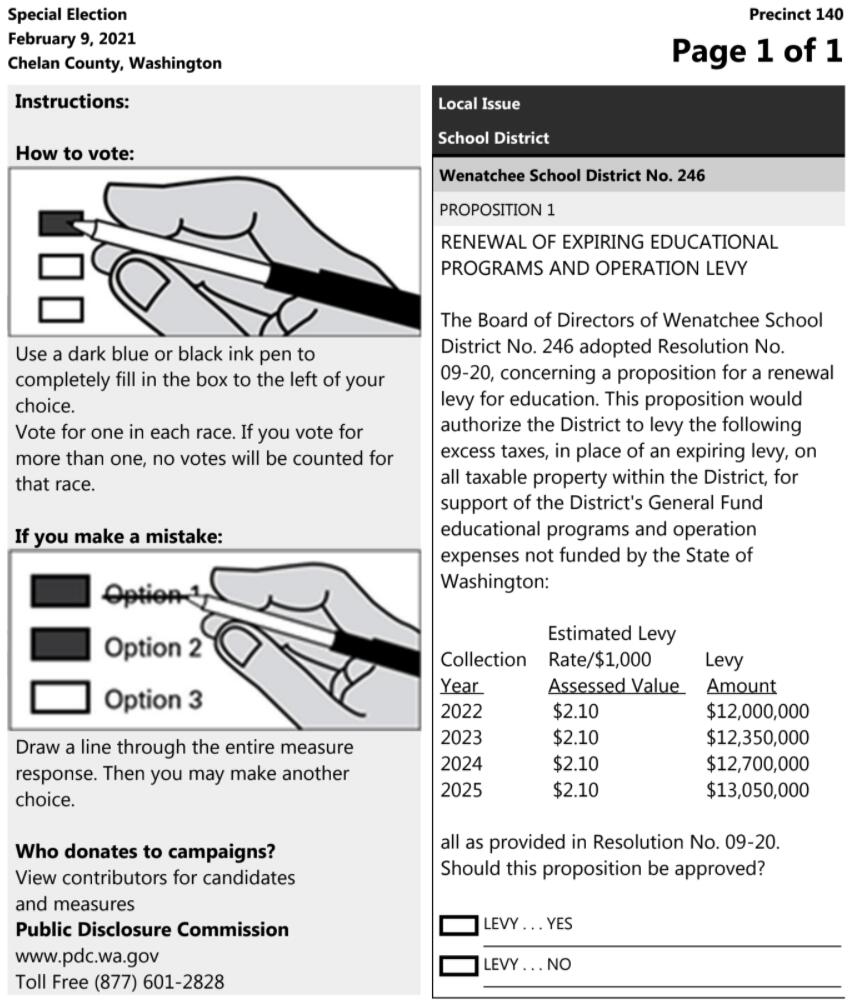

If approved, the four-year $12-$13.05 million levy will continue the $2.10 rate per $1,000 assessed property value that was previously approved by taxpayers.

Example: For a home valued at $400,000, the levy part of the tax would be $840 in 2021.

The levy amount increases 3% each year to account for property value increases but the rate is projected to stay the same at $2.10.

See the following table:

| COLLECTION YEAR | LEVY RATE PER $1,000 ASSESSED VALUE | LEVY AMOUNT |

|---|---|---|

| 2022 | $2.10 | $12,000,000 |

| 2023 | $2.10 | $12,350,000 |

| 2024 | $2.10 | $12,700,000 |

| 2025 | $2.10 | $13,050,000 |

See the following table for a history of levy rates per $1,000. The RED below are projected amounts.

| YEAR | Rate Per $1,000 | Yearly Tax Impact | |

|---|---|---|---|

| 2017 | $2.94 |

$1,176 |

|

| 2018 | $2.93 | $1,172 | |

| 2019 | $1.50 | $600 | |

| 2020 | $1.73 | $692 | |

| 2021 | $2.10 | $840.07 | Current Year |

|

2022

|

$2.10

|

$840

|

Projected

|

|

2023

|

$2.10

|

$840

|

Projected

|

|

2024

|

$2.10

|

$840

|

Projected

|

|

2025

|

$2.10

|

$840

|

Projected

|

If the voters don’t approve to renew the 4-year educational programs and operations levy the District will need to;

- Reduce spending by $15 million (Levy & LEA state match dollars)

- Reduce levy staffing, supplies and programs

In 2018 the district cut just 4.5 million from the budget. The renewal levy represents 3x that amount.

The district would need to try and re-run the levy in April and if it fails at that time, again in August.

Yes. This maximum dollar amount is known as the “Levy Lid.” As part of the changes the Legislature made to the way the state funds education in Washington, also known as the “McCleary decision,” Levy rates for the District are capped at $2.50 per $1,000 of assessed property value.

Restrictions on Maximum Collections

$2.50 per 1,000 of taxable assessed values (2019 was $1.50)

$1.50 per 1,000 required to receive maximum state equalization funding

Yes! If you are at least 61 years old on December 31 ofthe application year with an annual household disposable income of $43,588 or less, or unable towork because of a disability, or a veteran with an 80%disability rating for a service connected disability, youmay be eligible for the Washington State property tax exemption program (dor.wa.gov). For information about your status, contact the office of the Chelan County Assessor at (509) 667-6364.

The levy renewal must be approved by voters with a yes vote of 50% + 1.

Levy Informational Flyer

Levy Information Presentations

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.

/WSD-horizontal-logo-small-RGB.png?mask=1)